housing allowance for pastors fannie mae

Today the Federal Housing Finance Agency FHFA proposed new benchmark levels for the m ultifamily housing goals for Fannie Mae and. Therefore the housing allowance is not reported on the personal tax returns as.

2008 Financial Crisis And Fannie Mae Day 3 C Span Org

However housing expenses are subject to social security tax along with the.

. It is a form of income to fully pay or at least offset a part. The payments officially designated as a housing allowance must be used in the year received. The payments officially designated as a housing allowance must be used in the year received.

In addition this is saving pastors a total of about 800 million a year. Include any amount of the allowance that you cant exclude as wages on line 1. The housing allowance for pastors is not and can never be a retroactive benefit.

Additional Requirements for Doing Business with Freddie Mac. What is a Clergy Housing Allowance A housing allowance is often a common and critical portion of pastoral income. According to Christianity Today 81 of full-time senior pastors take advantage of the housing allowance.

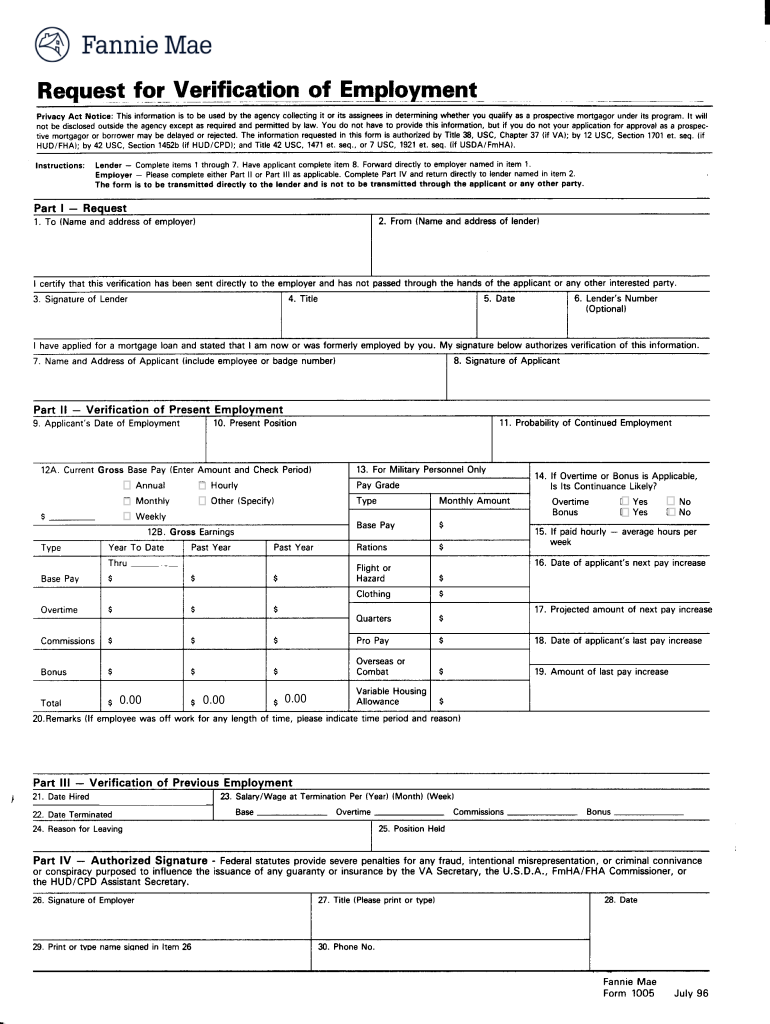

The preferred way to do this is for the church councilboard to. Only expenses incurred after the allowance is officially designated can qualify for tax. Many mortgage lenders apply a gross up factor of 25 percent when a housing allowance is also tax-exempt.

The IRS looks at the housing allowance portion of a pastors income as an exclusion from income. A pastors housing allowance must be established or designated by the church or. All states except Pennsylvania allow a ministers housing expenses to be tax-free compensation.

Your housing allowance is also limited to an amount that represents reasonable pay for your ministerial services. Include any amount of the allowance that you cant exclude as wages on line 1. That means that if you only work ten hours a week at the.

For an automobile allowance to be considered as acceptable stable income the borrower must have received payments for at. 2000 Doing Business with Freddie Mac. Fannie Mae Housing Allowance.

If a clergys annual compensation is 65000 and their church has designated a housing allowance of 15000 they subtract that from their salary bringing their. For example in mortgage lending a 1000 monthly tax-exempt housing.

Fannie Mae 1005 1996 2022 Fill And Sign Printable Template Online Us Legal Forms

Pastoral Housing Allowance Using Nontaxable Income To Buy A Home

Tim Pagliara Timpagliara Twitter

Biden S Eviction Ban Wins In Court Fannie Mae To Include Rent Payments In Underwriting More Of The Week S Top News National Mortgage News

Fannie Mae Sees Lower Amortization Income On Softer Refi Activity Otcmkts Fnma Seeking Alpha

Fannie Mae Employee Benefits And Perks Glassdoor

Multifamily Fannie Mae Loans Multifamily Loans

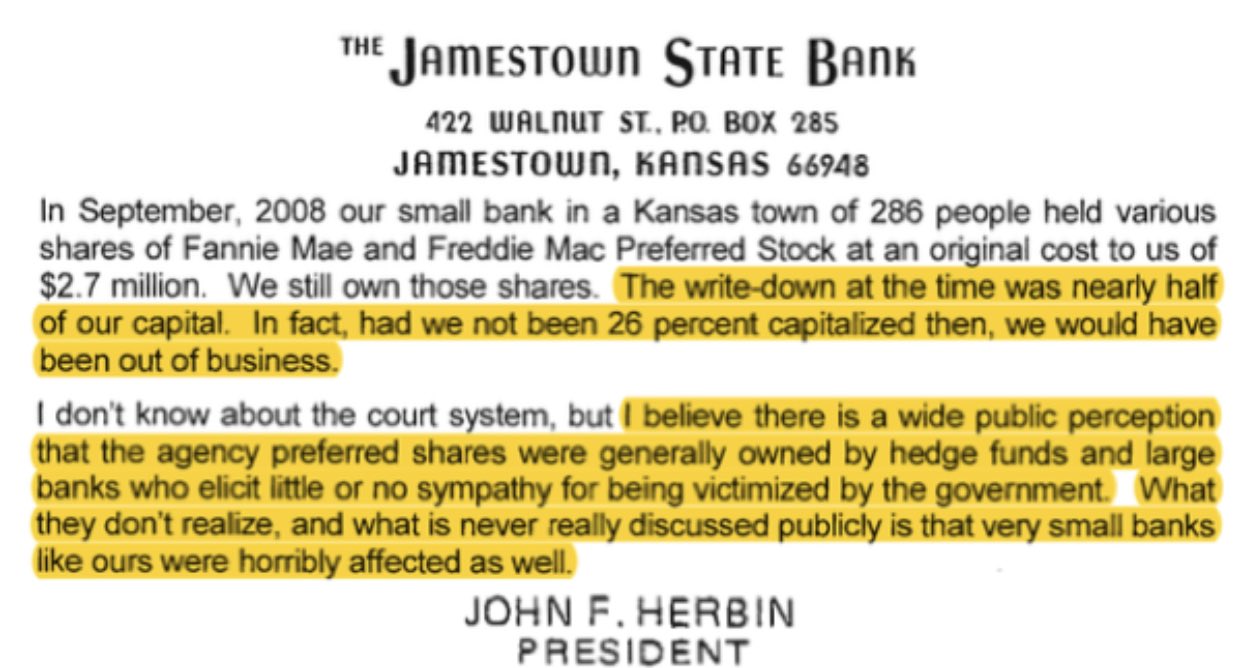

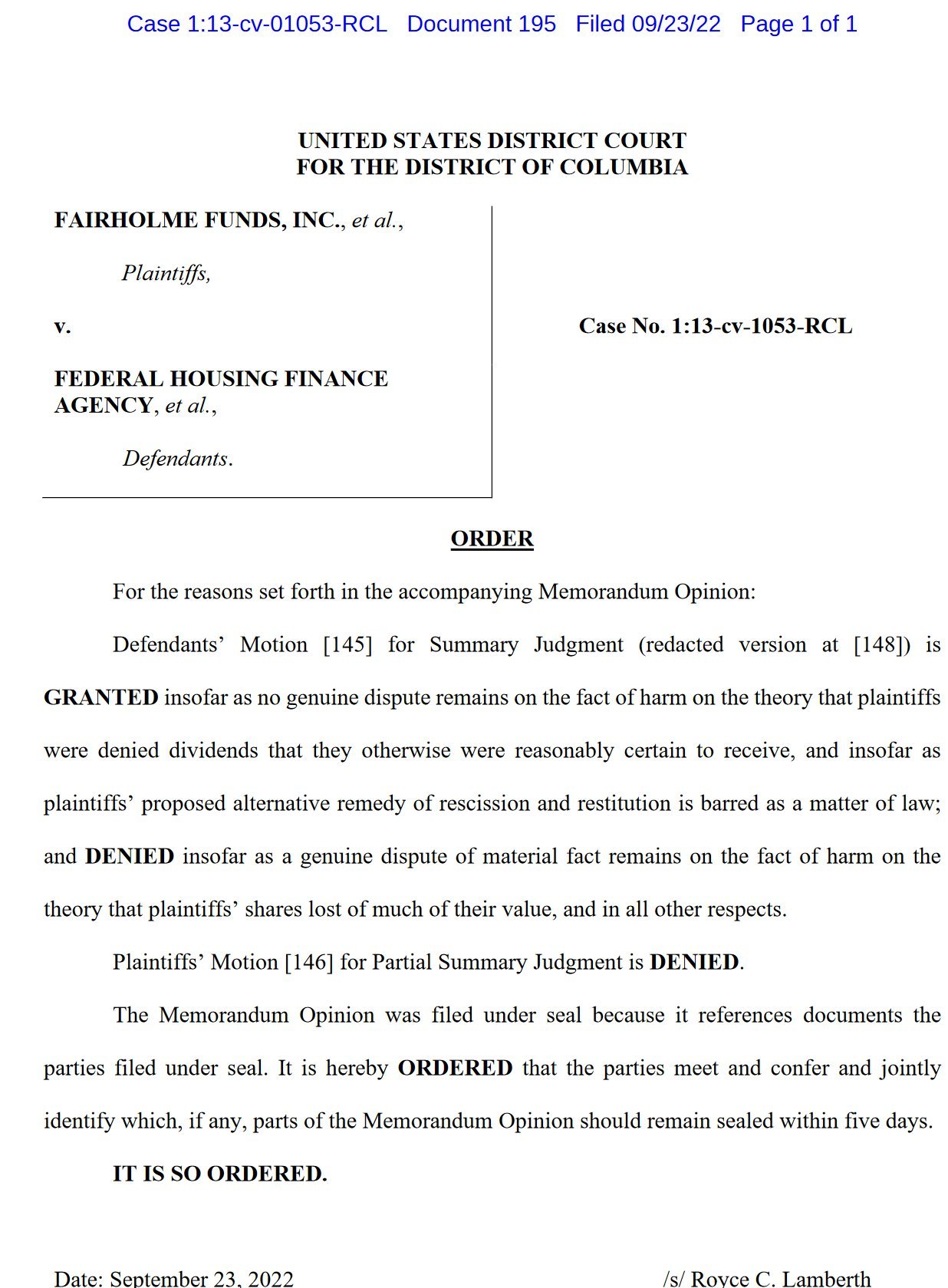

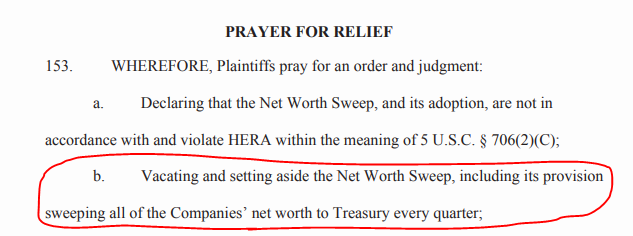

Gse Receivership Avoided Otcmkts Fnma Seeking Alpha

Fannie Mae And Freddie Mac Executive Bonuses C Span Org

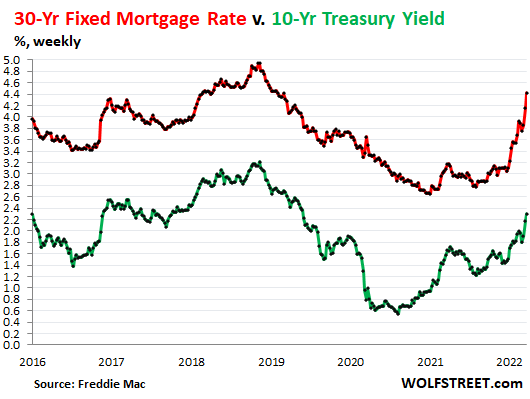

Mortgage Rates Are Rising Much Faster Than Treasury Yields What S The Deal Wolf Street

Fannie Freddie Both Pass 2022 Stress Test Despite Misalignment On Risk Rating American Banker

Fannie Mae S Cecl Solution May Include More Risk Sharing National Mortgage News

Book Review Shaky Ground Exposes Zombie Side Of Freddie Fannie

Fannie Mae And Freddie Mac Executive Bonuses C Span Org

Does The Down Payment On A House Qualify For The Minister S Housing Allowance The Pastor S Wallet

Fannie Mae Makes 26 Million Lihtc Investment Housing Finance Magazine

Fannie Mae Is Rebuilding Capital To Exit The Conservatorship Halfway There Seeking Alpha