montgomery county maryland earned income tax credit

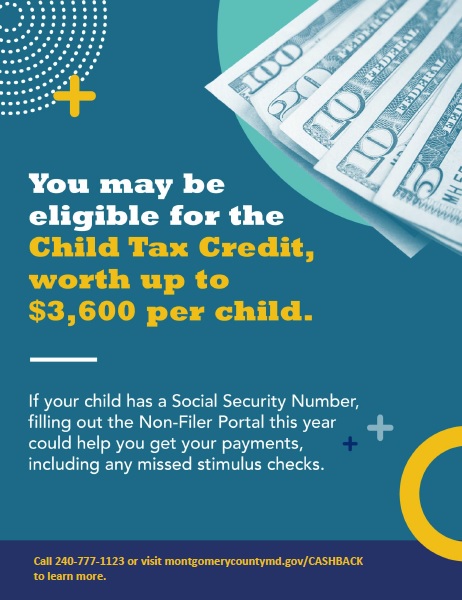

On March 5 2021 the Maryland General Assembly enacted Senate Bill 218 Child Tax Credit and Expansion of the Earned Income Credit. The tax credit can reduce the amount of taxes a resident owes or it can provide a refund.

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Faulkender thinks Montgomery County would be better served by giving low-income residents an earned income tax credit.

. It is important to note that Montgomery County is the only ounty in Maryland that offers a local C income tax credit for its. Montgomery County Division of Treasury 27 Courthouse Square Suite 200 Rockville MD 20850. Tax rate for nonresidents who work in Montgomery County.

There is a regular State EIC and a Refundable EIC component. The Earned Income Credit or EIC is a credit that is income based and is initiated by filing Maryland income taxes by April 15th of every year. Providing a local earned income tax credit to Montgomery County residents will enable approximately 13600 households to receive an average refund of 330 with a maximum of 614 once the State refundable portion is fully phased in.

For example if the State refunds 100 the County will add an additional 100. CASH Campaign of Maryland 410-234-8008 Baltimore Metro Comptroller of Maryland 1-800-MD-TAXES 1-800-638-2937 To find a Volunteer Income Tax Assistance VITA site offering free tax prep in your area call 410-685-0525 or 1-800-492-0618 and the. Residents of Montgomery County pay a flat county income tax of 320 on earned income in addition to the Maryland income tax and the Federal income tax.

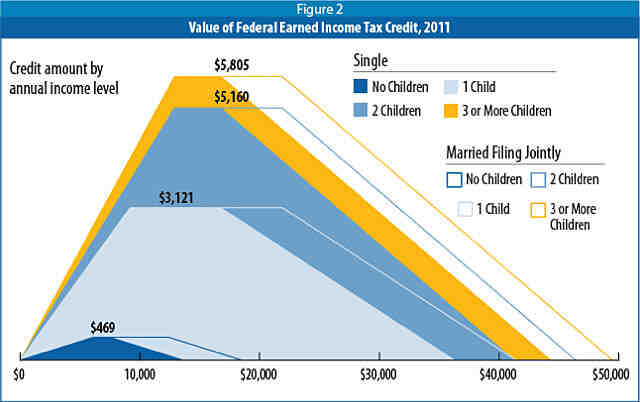

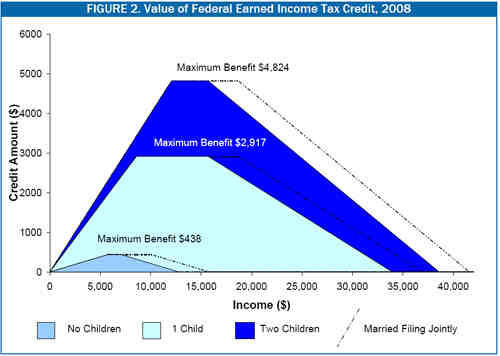

The amount of credit is 80 of the eligible assessment in each of the first 5 years and the credit deceases 10 annually 70 60 50 40 30 for the subsequent. The tax credit is for certain people who work and have earned income below a certain amount. Montgomery County Public Schools.

In a case of terrible timing as county tax revenues began to fall the Montgomery County Council decided to save a little money by scaling back the WFIS to 725 percent of the state EITC in FY 2011 689 percent in FY 2012 and 725 percent in FY 2013. In 2015 the EITC lifted about 65 million people out of poverty including about 33. The Countys cost for implementing the tax credit program is estimated to be approximately 45 million per year.

If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. Now not only were they facing. If you earn less than 57000 per year you can get free help preparing your Maryland income tax return through the CASH Campaign.

The refund is separate from the Maryland state tax refund and will arrive separately. Answer a few quick questions about yourself to see if you qualify. All fields are required.

Montgomery County Council unanimously approved the Working Families Income Supplement Bill which alters certain requirements for residents to qualify for the Working Families Income Supplement WFIS. If you qualify for the federal earned income tax credit also qualify for the Maryland earned income tax credit. For wages and other income earned in.

Earned Income Tax Credit Eitc Awareness Day On. Real Property Tax Credit A ten-year tax credit against local real property taxes on a portion of real property expansion renovation or capital improvement. By Online Ticket By phone.

The credit is equal to 50 of the federal tax credit. Montgomery County Refundable Earned Income Credit. Highlighting the positive impact of the Earned Income Tax Credit EITC County Executive Isiah Leggett and the County Council proclaimed today as Earned Income Tax Credit EITC Awareness Day.

If you earn less than 57000 per year you can get free help preparing your maryland income tax return through the cash campaign. Montgomery County will match a taxpayers State Refundable EIC dollar for dollar. Does Maryland offer a state Earned Income Tax Credit.

This decision only made things worse for low-income families. Put The Earned Income Tax Credit To Work For Your Community The Administration For Children And Families 2. The Maryland earned income tax credit EITC will either reduce or eliminate the amount of the state and local income tax that you owe.

Montgomery County Working Families Income Supplement. In May 2019 Governor Larry Hogan R signed legislation to significantly increase the size of the states Credit for Child and Dependent Care Expenses expand the income limits and make the credit refundable for single filers with incomes. It is important to note that montgomery county is the only c ounty in maryland that offers a local income tax credit for its residents with a 100 match of the state earned income credit for the applicable tax year.

In 1999 Montgomery County was the first local jurisdiction in the nation to introduce a Refundable Earned Income Credit EIC. In Montgomery County and Washington County for tax years 2007 and later the position can be a contract position of definite duration lasting at least 12 months with an unlimited renewal option. Maryland United Way Helpline dial 211 or 1- 800-492-0618 and the TTY line is 410-685-2159.

State earned income tax credit. Questions regarding eligibility for either the State or Montgomery County EIC must be addressed to the State of Maryland Office of the. People dont have to worry about anybody living on 800 a month and not.

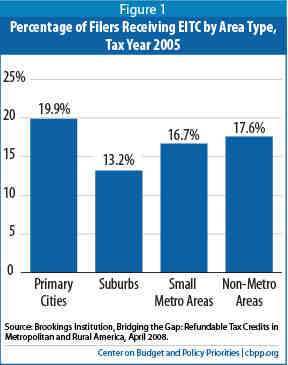

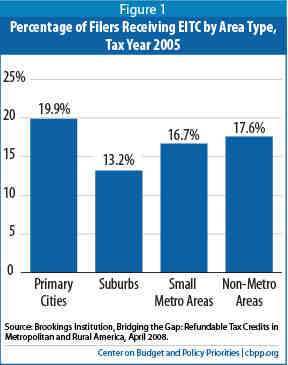

Vital Statistics data covering births in Maryland from 1995 to 2004 to examine whether the local EITC impacted birth weight and the probability of low birth weight in Montgomery County. Montgomery County is among a few jurisdictions across the country - and the only in Maryland - with a local match to the States earned income credit called the WFIS. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income.

You may be eligible to claim an earned income tax credit on your 2021 federal and state tax returns if both your federal adjusted gross income and your earned income are less than. The EITC is one of the countrys most successful anti-poverty efforts. Montgomery county maryland earned income tax credit Monday February 28 2022 Edit.

This year presents a special opportunity for eligible taxpayers with dependents and without to increase their refunds due to increases of federal State and local tax credits. Nonresidents who work in Montgomery County pay a local income tax of 125 which is 195 lower than the local income tax paid. Select the tax year you would like to check your EITC eligibility for.

In 1998 Montgomery County Maryland adopted a local earned income tax credit EITC program. See the Montgomery County website for more.

3 Things You Probably Don T Know About The Earned Income Tax Credit

Montgomery County Volunteer Income Tax Assistance Program Vita

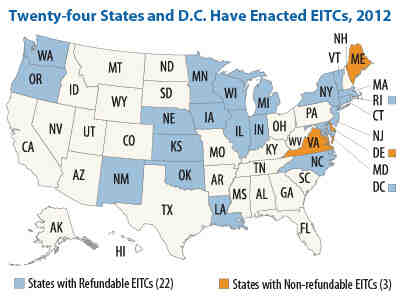

A Hand Up How State Earned Income Tax Credits Help Working Families Escape Poverty In 2011 Center On Budget And Policy Priorities

Montgomery County Md 311 Answering To You

Earned Income Tax Credit Wikiwand

A Hand Up How State Earned Income Tax Credits Help Working Families Escape Poverty In 2011 Center On Budget And Policy Priorities

Montgomery County Md 311 Answering To You

Montgomery County Volunteer Income Tax Assistance Program Vita

State Earned Income Tax Credits 2008 Legislative Update

Earned Income Tax Credit Wikiwand

Montgomery County Md 311 Answering To You

Earned Income Tax Credit Wikiwand

Maryland Lawmakers Work On Tax Relief Proposals

State Earned Income Tax Credits 2008 Legislative Update Center On Budget And Policy Priorities

State Earned Income Tax Credits 2008 Legislative Update Center On Budget And Policy Priorities

Child Tax Credit Health And Human Services Montgomery County